That said, a search button might also prove a good addition for a purely digital platform, but there are two onsite calculators – one for refinance and one for affordability - that can be used to get an approximate idea of your costs. The advice and insight is clear and informative, and you can give them a call if there are any further questions you need to ask. The Rocket Mortgage site is easy to navigate, with plenty of prominent buttons, a learning center and a well laid-out FAQ section. While the company’s commitment to providing a personalized rate can be seen as a positive, if you just want a quick idea of the rates on offer, this can also prove a frustration. Instead, you’ll need to create an account before you can really dig into your costs and estimates, with the size and type of the loan, your credit score, and interest rates all playing a role in determining how much you’ll pay to borrow the money. It is suggested that you will need between 2% and 5% of the purchase price for closing costs – even for no-down-payment loans, such as VA loans - but that's about all there is upfront. There’s no cost associated with seeing your mortgage recommendations or to get approved, but it is difficult to find information about APRs and fees solely from the Rocket Mortgage site. Rocket Mortgage review: Interest rates and charges You will also be asked for your online banking username and password, or details about how much money is in each account you want considered for your approval – this could include checking and savings accounts, retirement accounts, stocks and other assets. To apply, you will need your income and employer information, your Social Security number, and a separate email address for each person that will be on the loan.

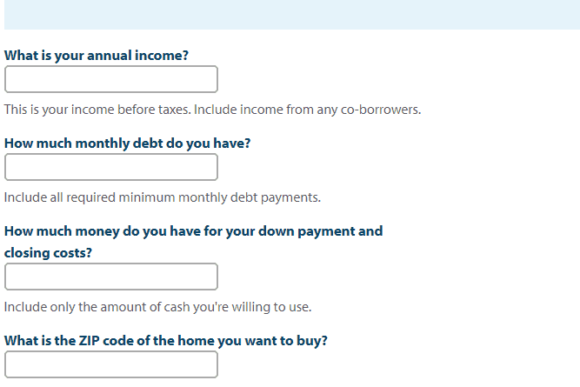

In general, it is suggested that you have at least 3% of the home’s purchase price for a down payment. In terms of how much money you need to buy a home with Rocket Mortgage, much depends on the type of loan and the value of the home in question. (Image credit: Future) Rocket Mortgage review: Other requirements Rocket Mortgage review: Application process The platform provides conventional loans, FHA loans, VA loans and jumbo loans. Alternatively, if you want to avoid affecting your credit score before committing to a Rocket Mortgage solution, there are calculators that can be used to get a rough idea of your costs.Ī refinance mortgage with Rocket Mortgage allows you to take a loan for cash, lower your payment terms, shorten your payment terms, or create your own combination of the above. That said, it subsequently provides an accurate quote that, rather than being just an estimate of what you can expect, is actually a solid offer that can be used to make a sound decision. Offering up a large selection of lenders and the most competitive terms, there's no better place to start your search.Īs Rocket Mortgage will affect your credit score when you apply, it is best to make sure it is the platform you want to use, or else have between three and five points to lose on your score, before you start.

View Deal On is where to look for fast access to the best mortgage and refinance.

0 kommentar(er)

0 kommentar(er)